The U.S. housing market in 2025 is in a state of flux, with home price growth slowing to 2.7% annually, according to the S&P CoreLogic Case-Shiller Home Price Index, and median existing-home prices hitting $422,800 in May. High mortgage rates, averaging 6.89% for a 30-year fixed loan, are keeping buyers cautious, while inventory has improved to a 4.6-month supply, though still below the balanced 5–6 months. Experts warn that a rapid drop in rates could spark demand, potentially wiping out inventory gains and pushing prices higher.

Unlike the U.S., where affordability challenges dominate, Nova Scotia—particularly Halifax—is experiencing a historic housing boom that’s reshaping the province. Nova Scotia’s housing market in 2025 is buzzing with opportunity and change, offering something for buyers, renters, and developers. From Halifax’s urban boom to the quieter growth in Amherst and the Annapolis Valley, the province is navigating a historic surge in housing supply amid shifting migration patterns and evolving policies. Whether you’re dreaming of a new home, a rental, or a development project, here’s a clear, fact-checked guide to what’s happening and what it means.

Halifax’s Housing Surge: 11,000 New Units on the Horizon

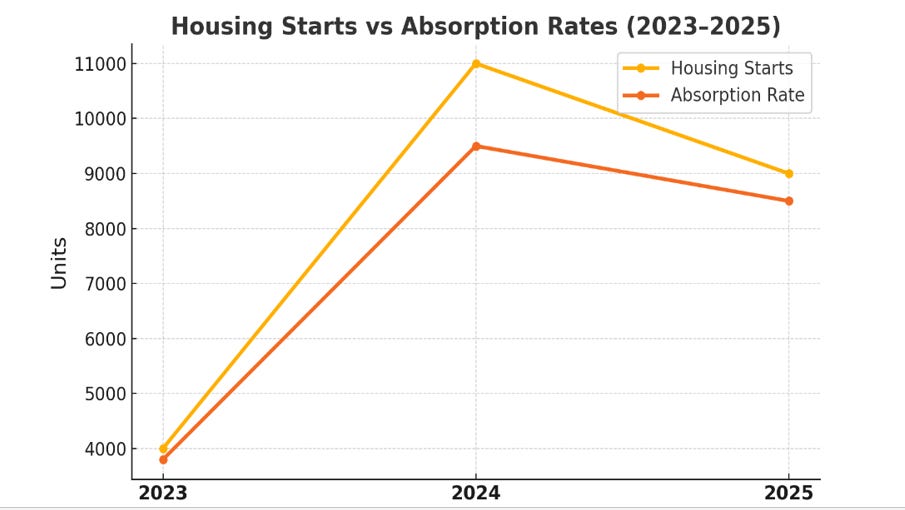

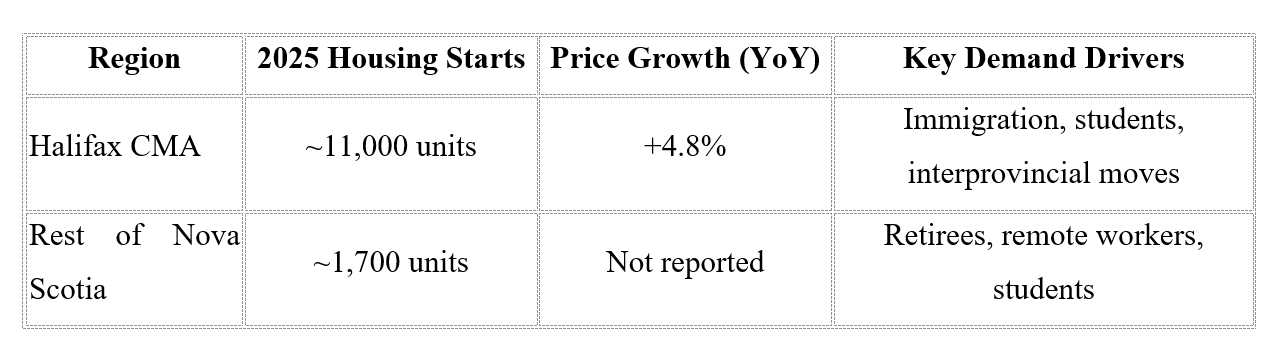

Halifax is bracing for an unprecedented influx of approximately 11,000 new housing units, nearly triple the typical annual average of 3,000 units. Provincially, housing starts hit 12,773 units in April 2025, a 65.6% jump from the previous month, far exceeding the province’s usual target of 5,450 starts per year. This boom is driven by government initiatives to address housing shortages, but with so many new homes, the question is: who will fill them?

Demand Under Pressure: Immigration, Students, and Policy Shifts

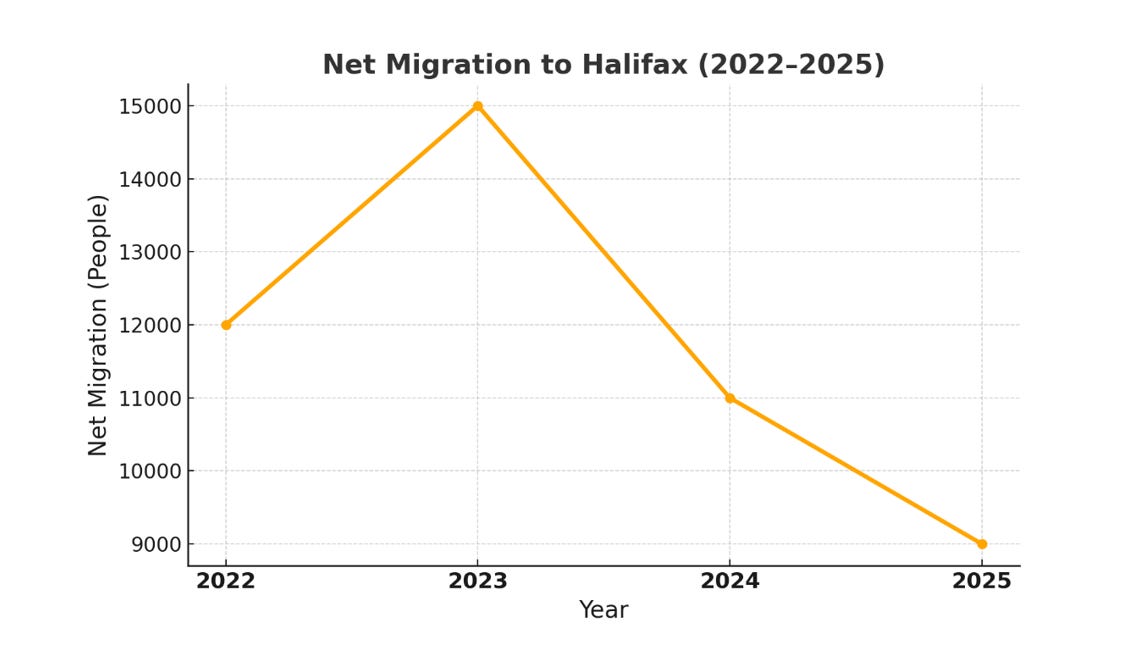

Historically, Halifax’s housing demand has relied on immigrants, international students, and temporary residents transitioning to permanent residency. In 2024, Halifax’s population grew by 11,600 (2.4%), with 10,000 new permanent residents driving much of that growth. However, federal policies are tightening; immigration targets are dropping in 2025; study permits are projected to fall to 516,600 nationally by 2026; only 40% of new permanent residents in 2025–2027 will come from within Canada, with stricter quotas on programs like the Nova Scotia Nominee Program (NSNP). These changes could slow demand for Halifax’s new units.

A Developer’s Perspective: “The Units Always Fill”

Despite concerns about softening demand, confidence among Halifax’s major developers remains high. One of the city’s most notable developers, a Canadian of Lebanese origin with three decades of experience, summed it up: ‘Every time I start a project, people ask, “Where will the renters come from?” And every time, the units fill up. I’ve weathered countless market cycles, and Halifax always finds its footing.’

This optimism is backed by Halifax’s resilient demand, including local buyers, students needing rentals near universities like Dalhousie, and professionals drawn to the city’s economic sectors and lifestyle. In 2024, Halifax home sales rose 8% to 4,508, with average prices up 4.4% to $578,913.

But not all developers are created equal. According to the Halifax Urban Development Institute’s Q1 2025 report, 30% of proposed high-rises are facing delays due to financing challenges.

Migration Trends: From Remote Work to Return-to-Office

Post-COVID, Nova Scotia became a migration hotspot, with a net gain of 11,701 people from other provinces in 2021–22, driven by remote workers fleeing high-cost cities like Toronto and Vancouver. Halifax’s median new home price of $426,600 in May 2025 is a relative bargain.

However, return-to-office policies have slowed this trend, with net interprovincial migration dropping to 2,252 in 2023–24. Still, Halifax’s affordability and growing industries continue to attract professionals, supporting long-term demand. Mike Moffatt of the Smart Prosperity Institute observes that the remote work migration isn’t over — it’s simply less frantic. Halifax’s mix of affordability and lifestyle continues to draw young professionals.

Opportunities for Developers: Capitalizing on the Boom

Developers have a unique opportunity in 2025, but it requires strategy. Halifax’s 11,000 new units, plus 1,700 across the rest of Nova Scotia, align with the province’s 16 Special Planning Areas (SPAs) fast-tracking over 60,000 new homes, including projects like Seven Lakes in Porters Lake and Long Lake Village near Northwest Arm Drive. The tight rental market (low vacancy rate ~3%, rents up 4.8% in December 2024) offers potential for purpose-built rentals and student housing. However, CMHC’s de-risking, tightening lending and guarantees, means developers must focus on affordable, energy-efficient projects to secure funding and attract buyers.

On a different note, while housing starts are a leading indicator, absorption rates are ultimately more telling. If migration slows, Halifax could face a short-term condo oversupply, though rental markets are expected to remain tight as John Dickie, Canadian housing policy analyst, notes. Construction costs are the other major crucial factor, with CMHC warning of persistent cost inflation across new builds.

Amherst and the Annapolis Valley: Hidden Gems

Amherst and the Annapolis Valley are emerging as lower-risk opportunities for developers and affordable options for buyers. Amherst could benefit from CMHC’s Housing Accelerator Fund, supporting 112,000 new homes nationwide by 2028, targeting rentals and homes for retirees and students. It may not be much, but it is attracting a lot of investors with many multi-unit buildings on the way.

The Valley, with its community colleges and rural charm, sees steady demand for single-family homes and apartments, with about 1,700 housing starts in 2025 across non-Halifax regions. Prices here are more stable than Halifax’s 4.8% year-over-year growth, making these areas attractive for budget-conscious buyers.

Even if opportunities seem to extend beyond those two areas, the Valley is a safe bet. Many authorities on subject note that investors should look closely at Wolfville and Kentville, where university activity and wine tourism continue to drive demand.

This doesn’t mean those areas are risk-free. A 2025 CMHC report points out that smaller towns face higher vacancy rates, 5.2% compared to Halifax’s ~3%.

Challenges and Strategies for Developers

Developers face challenges like rising construction costs, per the Building Construction Price Index, and a struggling commercial real estate sector due to hybrid work trends. To succeed, they must focus on:

· Smart cost control via sustainable growth and balancing quality and profitability on a project-by-project basis.

· CMHC funding: smaller developers in Amherst and the Valley can target CMHC affordable projects while they last, while Halifax developers should target early-phase SPAs for premium lots.

- Energy-efficient designs and smart home features to appeal to modern professionals.

- Flexible units in high-demand areas like Dartmouth or Clayton Park.

- Mixed-use projects to offset commercial real estate weakness.

What This Means for Buyers and Renters

For buyers and renters, 2025 offers opportunities:

- Halifax: The 11,000 new units mean more choices and potential deals, though new home prices are up 4.8% year-over-year. Mortgage rates require careful budgeting.

- Amherst and the Valley: More affordable with less price pressure, ideal for first-time buyers or retirees.

- Renters: Growing supply could ease Halifax’s tight 2.5% projected vacancy rate, offering better deals, especially in suburbs or the Valley.

Visualizing the Market

Nova Scotia’s housing market in 2025 is at a pivotal moment, with Halifax’s new units poised to either ease chronic shortages or risk oversupply if demand falters. Amherst and the Annapolis Valley offer affordable, less competitive options for buyers and developers. In contrast to the U.S., where Forbes highlights a cautious market—high mortgage rates and low builder confidence (NAHB index at 32) are dampening activity, with 46% of homes equity-rich as a buffer against foreclosures—Nova Scotia is a hub of opportunity. The province’s proactive initiatives, contrast with the U.S.’s wait-and-see approach, where a sudden rate drop could disrupt inventory gains. Despite challenges like reduced immigration, tighter NSNP quotas, and CMHC’s cautious lending, Halifax’s resilience, backed by a developer’s confidence and steady local demand, points to opportunity. Developers should seize this moment by building relatively affordable, energy-efficient units in high-demand areas, leveraging CMHC funding. Buyers and renters will have to explore growing inventory with tools like mortgage calculators and local agents to secure deals in this dynamic market.